The Current State Houston's Real Estate Market

A median home price that slipped to $320,000 in December 2025, down nearly 4% from the year before, has pushed Houston into rare territory among major U.S. metros: a market where buyers finally have room to maneuver. Inventory is climbing. Luxury demand is accelerating. And the city’s famously resilient housing ecosystem is showing its split personality more clearly than at any point since the pandemic boom.

Cooling in Some Areas, Luxury Sales Are Hot

Houston doesn’t behave like a monolithic market. It moves in layers.

Data from the Houston Association of Realtors (HAR) shows a city settling into balance rather than decline:

- Active listings up 18.9% year‑over‑year

- Median price down 3.8%

- Luxury sales up 23.4%

- Single‑family sales up 1.2%

Buyers have more leverage in the mid‑tier. High‑income households continue to transact aggressively. And sellers who anchored to 2021 pricing are adjusting expectations as the list‑to‑sale ratio drops to 92.2%, the lowest in more than two decades.

Why Inventory Is Rising Faster Than Prices Are Falling

Three forces are reshaping supply:

1. Builders Never Hit the Brakes

Houston’s permissive zoning and abundant land keep construction pipelines active. New homes continue to hit the market even as demand normalizes.

2. More Sellers Are Testing the Waters

After years of rapid appreciation, homeowners are listing earlier and more often. Buyers, however, are resisting inflated list prices, creating a softer negotiation environment.

3. Migration Has Stabilized

Houston still attracts steady inflows from California, Louisiana, and the Midwest, but the pandemic‑era surge has cooled. The result: demand remains healthy, but buyers no longer feel rushed.

Prices: A Gentle Slide, Not a Correction

The median listing price’s dip to $320,000 stands out because it outpaces the national decline. Yet the softness is concentrated in entry‑level and mid‑priced homes.

The luxury segment tells a different story: Homes above $1 million saw more than 20% year‑over‑year sales growth, driven by energy‑sector wealth, medical professionals, and out‑of‑state buyers seeking space and relative affordability.

This divergence underscores Houston’s economic diversity. High‑income buyers remain active even as rate‑sensitive segments wait for relief.

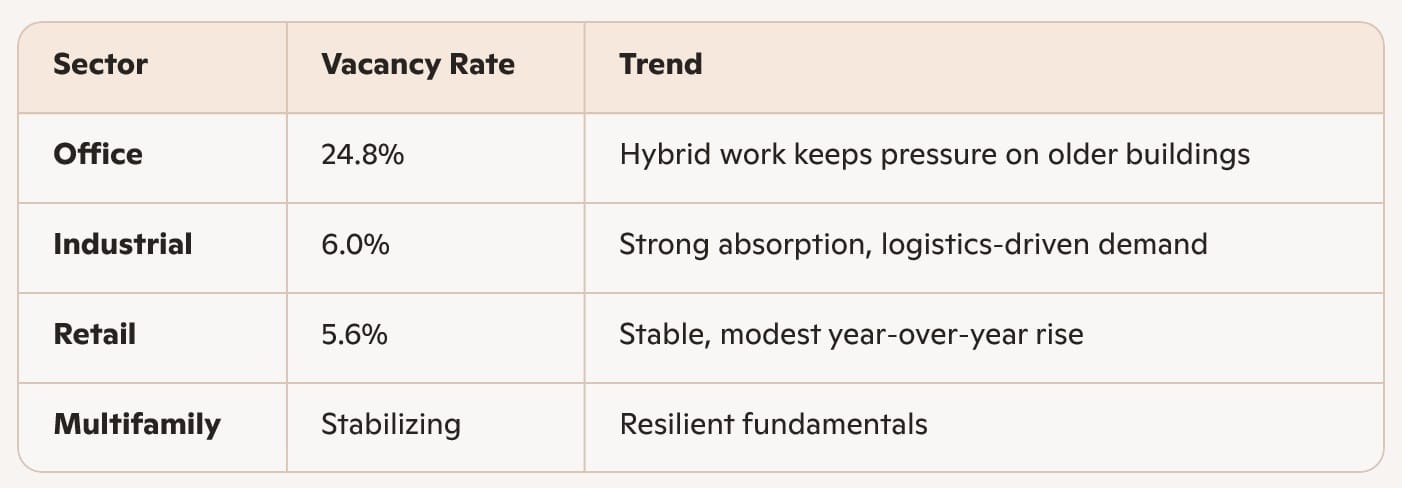

Commercial Real Estate: Mixed but Stabilizing

Residential trends mirror broader economic signals. According to Cushman & Wakefield, Houston’s commercial landscape shows a city recalibrating rather than contracting.

Industrial remains the standout performer, supported by port activity and distribution growth. Office continues to lag, though the Energy Corridor shows pockets of renewed leasing.

What Industry Leaders Are Seeing

HAR Chair Shae Cottar summed up the shift:

“Houston’s housing market is settling into a balanced pace. Buyers now have more time, more options and a little more breathing room to negotiate.”

That sentiment is echoed across brokerages. The frenzy is gone. The fundamentals remain and sellers who understand the new market dynamics will be able to sell their property.

Where the Market Is Headed

Forecasts from Houston real estate experts expect prices to stabilize and increase 3 to 5% throughout the year. The expectation is that the market will return to the fundamentals and interest rates will decrease a little more later this year, but no one expects interest rates to return to the lows buyers enjoyed in the early 2020s.

Key variables to watch:

- Mortgage rate movements

- Energy‑sector performance

- Builder activity and land availability

Houston’s long‑term strengths—population growth, job creation, and relative affordability—remain intact. The city is unlikely to experience dramatic swings, but subtle shifts will define the next 12–18 months.

FAQ: Houston Real Estate Market

Are home prices rising or falling?

Prices dipped 3.8% year‑over‑year, landing at $320,000 in December 2025.

Is Houston a buyer’s or seller’s market?

Conditions are balanced. Buyers have more leverage due to rising inventory.

Which segment is strongest?

Luxury homes. Sales above $1M grew more than 20% year‑over‑year.

How is commercial real estate performing?

Industrial is strong, office remains soft, retail is stable.

Is inventory increasing?

Yes—active listings rose nearly 19% year‑over‑year.

What’s driving the shift?

New construction, more sellers entering the market, and normalized migration.

What’s the outlook for 2025–2026?

Analysts expect modest appreciation and continued balance.

Is Houston still affordable?

Yes. Prices remain below national averages, even with recent fluctuations.

Sources

- HAR.com – Houston Housing Market in 2025: Steady Growth and Opportunities – https://www.har.com/blog_125991_houston-housing-market-in-2025-steady-growth-and-opportunities

- Realtor.com – Real Estate Market Trends in Houston, TX: Prices Fall – December 2025 – https://www.realtor.com/research/houston-december-2025-market-trends

- Norada Real Estate – Houston Housing Market: Trends and Forecast 2025–2026 – https://www.noradarealestate.com/blog/houston-housing-market

- HAR.com – Monthly Housing Update (Nov 2025) – https://www.har.com/content/newsroom

- Cushman & Wakefield – Houston MarketBeat Reports – https://www.cushmanwakefield.com/en/united-states/insights/us-marketbeats/houston

- The Jamie McMartin Group - Houston - Real Estate Forecast 2026 What Experts Expect for the New Year - https://thejamiemcmartingroup.com/houston-real-estate-forecast-2026-what-experts-expect-for-the-new-year/